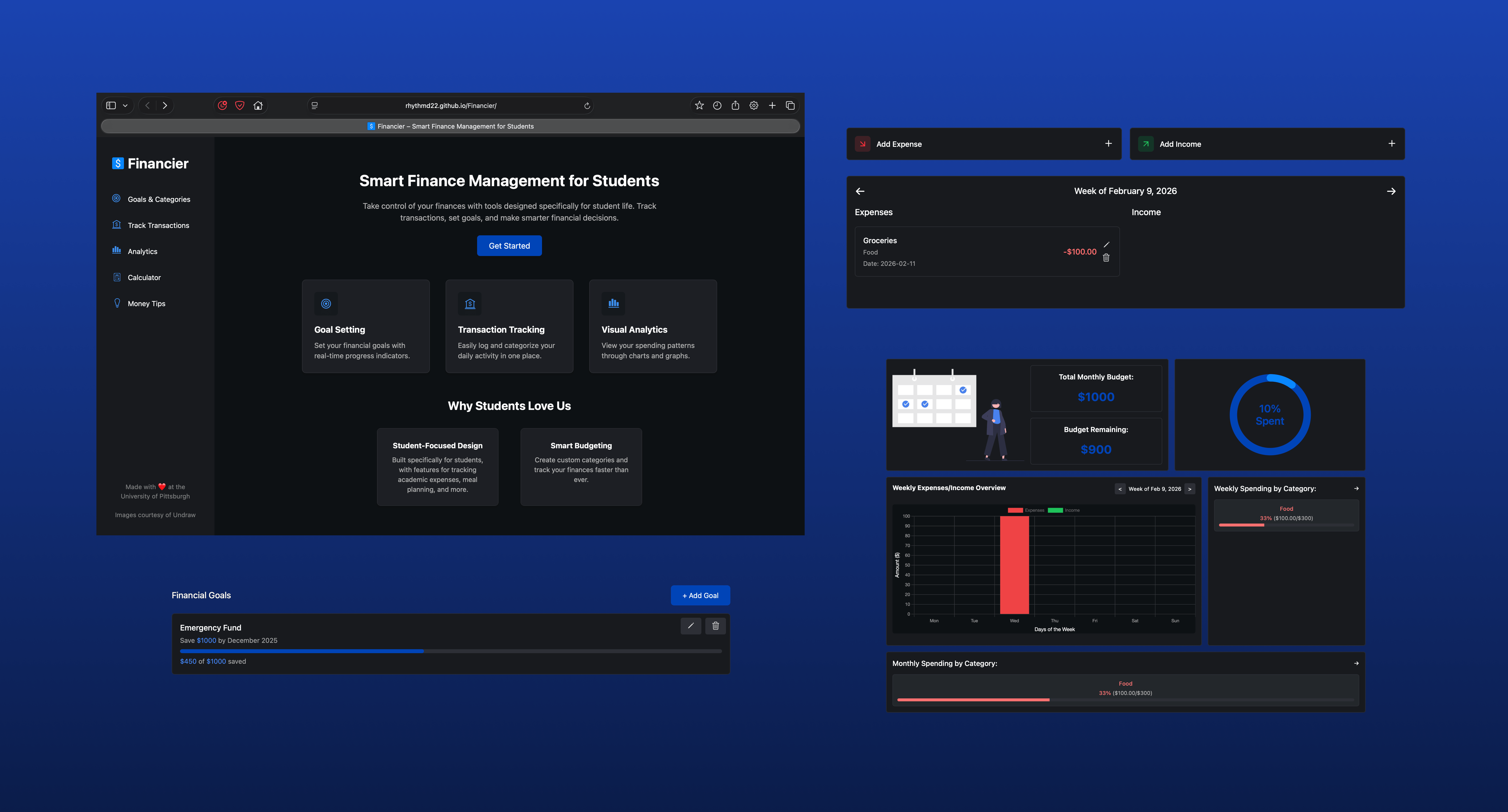

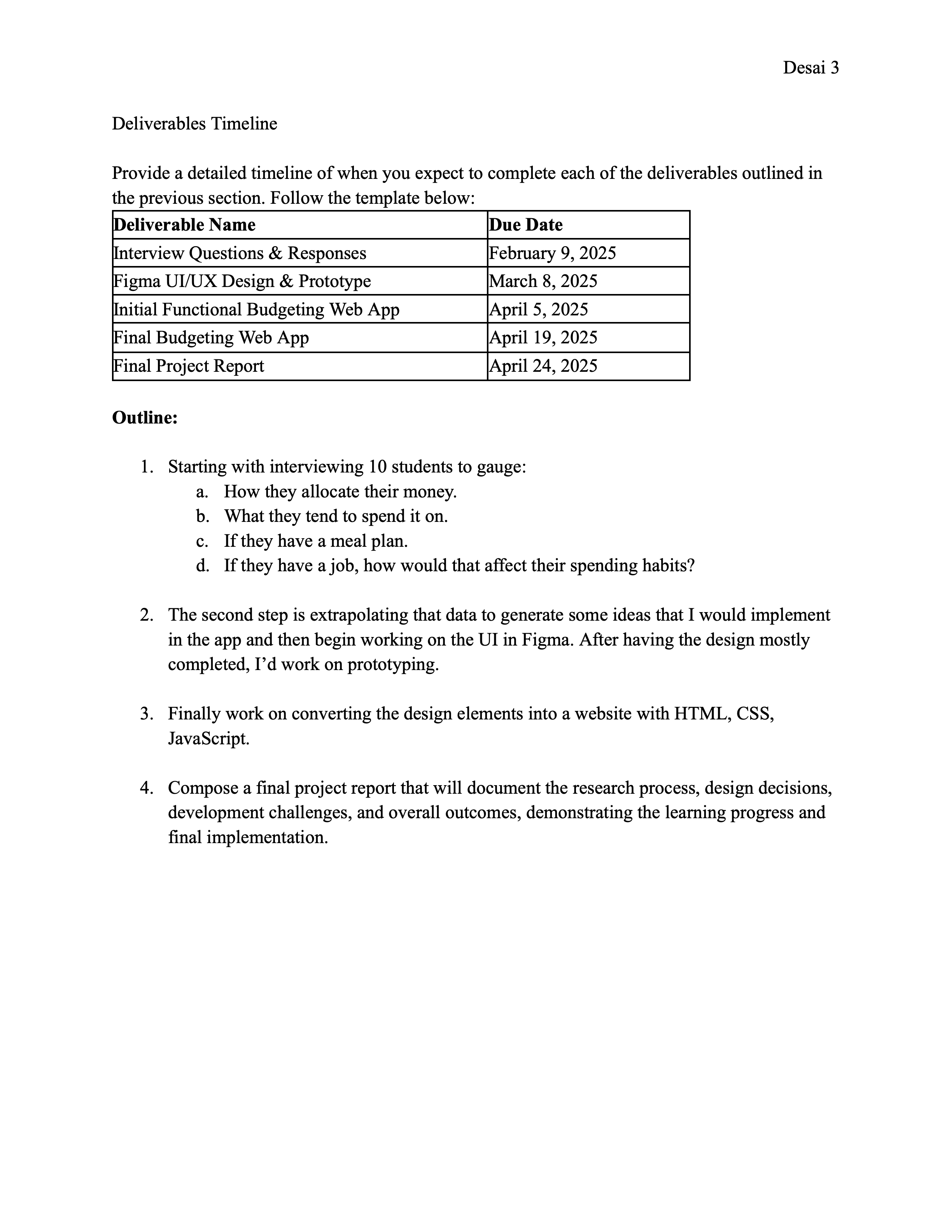

Financier Project

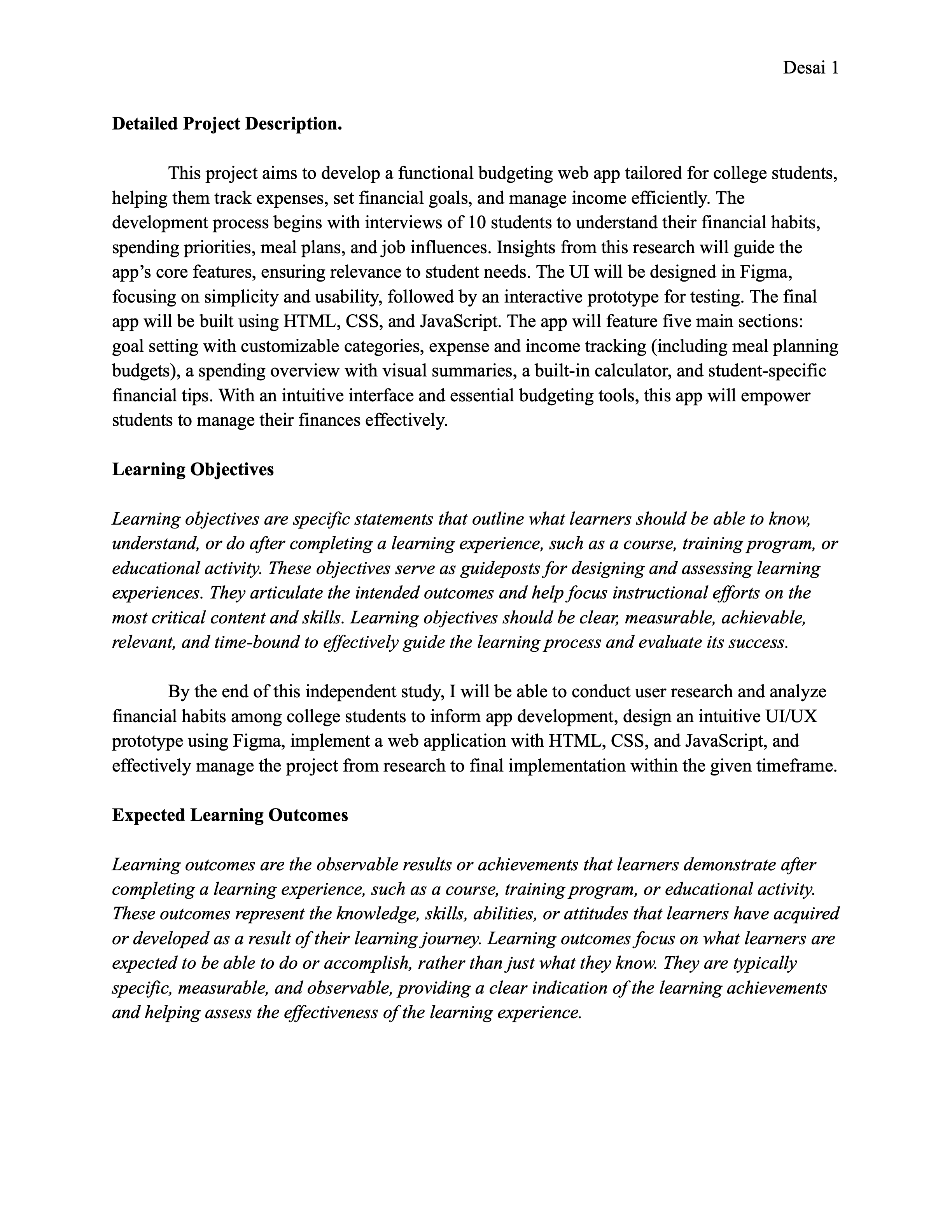

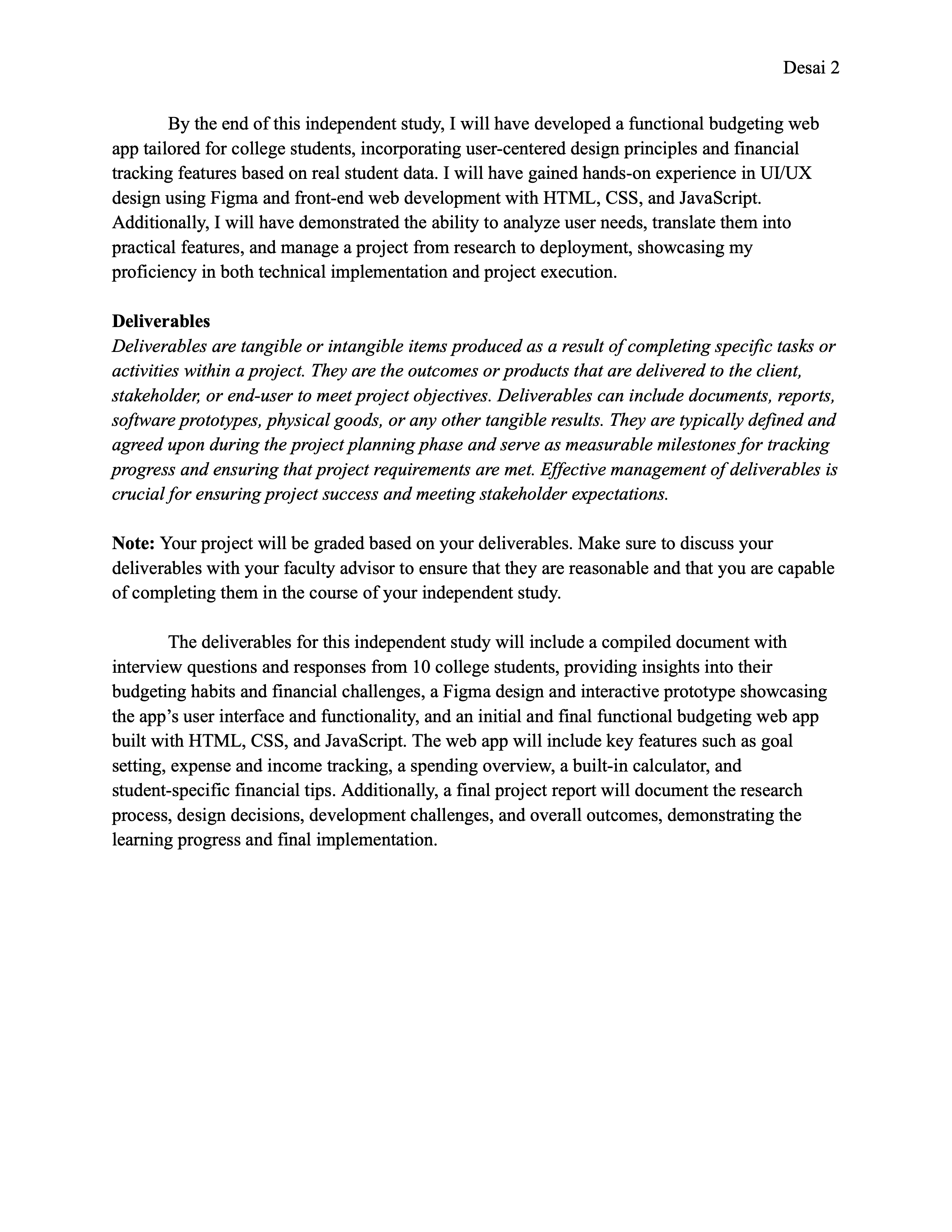

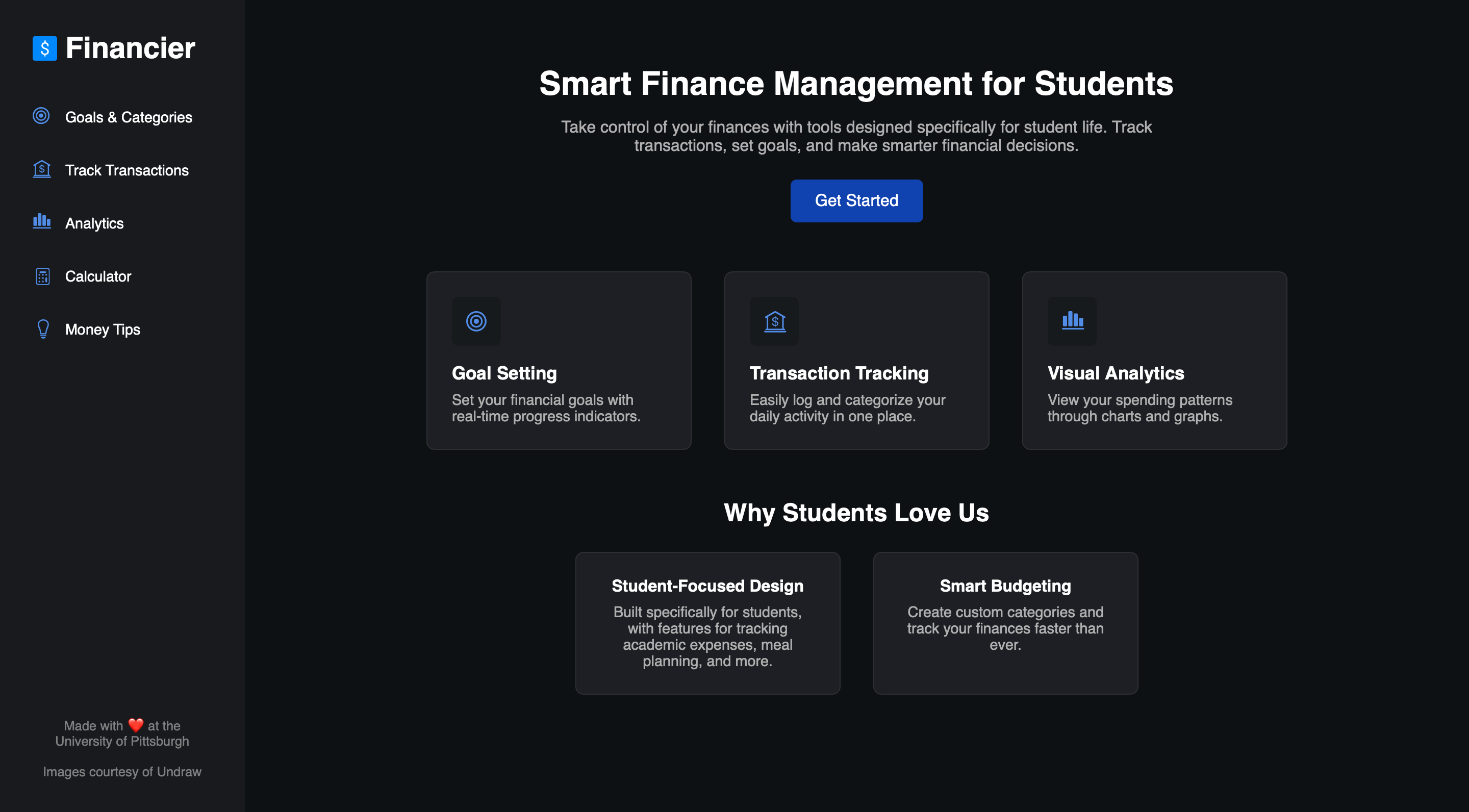

The Financier budgeting app was designed to help college students manage expenses, set goals, and track income with tailored features based on user research. It includes goal setting, transaction tracking, analytics, a built-in calculator, and categorized money-saving tips—all built with a responsive and intuitive UI.